Stock Advisor Results thru Dec 21, 2019

- Donnette Dawn

- Jan 1, 2020

- 23 min read

*** Motley Fool Review: UPDATED with Stock Pick Results as of December 21, 2019 ***

ALSO READ: How the startup ‘Billie’ is saving women money

In this Motley Fool review, I’m going to show you exactly what you really want to know about the Stock Advisor service.

I’m going to show you exactly what you get when you subscribe. And more importantly, I am going to show you how profitable buying their stocks has been for me over the last few years.

Since I have been a paid subscriber for over 4 years now, I will present just the FACTS about the Motley Fool stock picks so you can see for yourself if it is worth it. I subscribe to both their flagship ‘Stock Advisor’ service and their newer ‘Rule Breaker” service.

To have an objective test and analysis of the Motley Fool services, in December 2015 I opened an ETrade brokerage account dedicated just to buying the Motley Fool stock picks as they recommended them. For the last 4 years, starting in January 2016, I have bought approximately $1,000 of EACH and EVERY stock pick the Motley Fool has recommended.

So how has that ETrade account performed?

Quick Summary: The average return of all the stocks in my Motley Fool stock portfolio is 88.34% since January 2016. That means these stocks haves outperformed the market by an average of 48.18%. Keep reading to see the details of my Motley Fool stock portfolio and to learn 2 important tips I discovered along the way that really help to maximize my returns.

In this Motley Fool Review, I will tell you:

exactly what you get when you subscribe

when they will release their next new stock picks

the percentage of their stock picks that were profitable each year

the range of returns (the biggest winning pick and the biggest loser) each year,

the OVERALL results of their picks year after year,

and I will tell you how those picks are still doing today (HINT: the average return of their 72 stock picks from the last 3 years (2016, 2017, 2018 is +88.34%)

I will even share with you screen shots of my own brokerage account to prove to you my results of actually buying all of their stock picks from both services for the last 4 years.

I will also tell you 2 important trading tips about the Motley Fool services that I have learned over the years. Two little facts that you must understand about their services in order to maximize your profits.

Why Did I Write this Motley Fool Review?

I will try not to bore you, but I think it’s important to tell you a bit about myself and why I felt the need to write this review.

My story is probably not too different from yours. I grew up in a modest household where everything we owned was paid for with hard earned money.

I watched my parents work their a** off (excuse my french). They each worked 50+ hours a week to give our family the best lifestyle they could. Unfortunately, my father passed away six years ago just after his 65th birthday. He worked hard his whole life and planned to enjoy his retirement, but he died within months of retiring.

My dad’s death taught be a valuable lesson–I need to start building my personal wealth NOW so I can retire early and ENJOY my retirement.

My Mission

To accomplish that, I set out on a mission to find the best and the fastest way to build my stock portfolio in a proven and low-risk way.

I started out by talking to people I thought were smart and wealthy, reading countless books and magazines, and subscribing to various stock newsletters and stock picking services.

To save YOU a lot of time, here is a summary of what I learned…

The FIRST lesson I learned was definitely NOT to get stock tips from friends or chase rumors. My friends didn’t know any more than I did. But they sure acted like it, and they ended up costing me money and wasting my time.

The SECOND lesson I learned was that the sooner you start investing the right way, the faster your account will grow. It’s all about saving and investing a little each month, and the power of compounding. So stop thinking about investing, and start investing NOW! You will be surprised how quickly and easily your portfolio will start to grow.

The THIRD lesson I learned was that not all stock newsletters are worth the money. Over the last five years, I have subscribed to literally dozens of stock newsletters. I have also subscribed to another dozen software and/or charting services that are supposed to give me signals of what to buy. The truth is, most of them worked out just “OK.” With most of the services I found that when the markets were up, my portfolio went up. And when the markets were down, my portfolio went down too. My goal was to BEAT the market, no just match the market.

Eventually, I did find a stock service that were able to consistently outperform the market year after year. And by ‘outperform’….. I am talking about consistently beating the market by over 27% year after year!

…And that’s brought us both here so I can share my experiences with the Motley Fool Stock Advisor service.

So, let’s get started.

Everyone always ask me…

Is the Motley Fool Worth the Money?

Based on my experience over the last 4 years of buying every single one of their stocks picks, my analysis of their performance concludes absolutely YES!

The regular price of the Motley Fool Stock Advisor is $199 a year,. Even at that price it is very inexpensive compared to other services. But new customers can now subscribe for just $99 a year on THIS new subcriber page. At $99, it is absolutely a no-brainer given that the average return of their stocks picks is 88.34% (return as of December 21, 2019 for all of their picks from 2016, 2017 and 2018). Each year, these stocks have outperformed the market by at least 27.40%.

Ok, let’s get into the details of the Motley Fool…

MOTLEY FOOL PERFORMANCE REVIEW…

Just to whet your appetite, below are a few examples of their best performing stocks since they launched this service. Did you buy Amazon, Netflix, Bookings, and Disney a few years ago to earn these 10,000% returns? If you had subscribed to the Motley Fool Stock Advisor then you probably already own these 4 stocks!

So, is the Motley Fool Stock Advisor worth it?

Given that their AVERAGE STOCK PICK is up 392% since they launched the service–the answer is ABSOLUTELY YES–if you subscribed a decade ago.

But more importantly for YOU, you should be asking “how have their stocks picks been doing the last few years?” Given you already missed out on those 10,000% returns on those 4 stocks, how is it doing NOW?

Honestly, as to be expected, all of their picks are not profitable. Some go up as soon as they are recommended and never look back. Some go up just a few dollars and they seem to run out of steam. And some eventually drift lower. So the first thing you need to understand about the Motley Fool strategy is that they are focused on the longer term. With some picks you might need to wait a few months before they start going up. But the average return of their 72 stock picks for 2016, 2017, and 2018 is a very impressive +88.34%.

So, assuming you have some cash to invest each month, and you can let the money stay invested for a few years, it certainly seems like a very safe bet.

Also, here is another FACT that I like. The 2 Gardner brothers that started the Motley Fool years ago still run the company and make the stock recommendations. So, unlike other comparable stock newsletters, there has NOT been any change of management like you see at other advisory services.

This is an extremely important fact because you might find another newsletter that has also done well, but you never know who really is picking their stocks. With the Motley Fool, the 2 same brothers that started this newsletter have been there since day and there is no reason to believe they are leaving their own company.

Motley Fool Stock Advisor Summary

Here’s What You Get:

Two brand new stock recommendations and analysis per month delivered in real-time to your email.

on the first Thursday of the month there will be a new stock recommendation from Tom Gardner

on the third Thursday of the month there will be a new stock recommendation from David Gardner

Access to all of the Motley Fool’s Stock Advisor recommendations they made in 2019, 2018, 2017 and 2016.

The Motley Fool’s Top 10 Best Stock to Buy RIGHT Now report that features some of their recent picks that still offer the best potential return.

on the second Thursday of the month Tom will release his New Best Stocks to Buy Now

on the fourth Thursday of the month David Gardner will release his Top 5 Stocks to Buy Now

The Motley Fool’s Top 5 Starter Stocks report that features the ideal stocks that should be the foundation of new investor’s portfolios.

24/7 Monitoring: They will let you know when they believe it’s time to sell any of their stock picks

Toll-free customer service. Yes, real people answer the phone.

You also get:

A clear explanation of WHY they recommended each stock and the factors considered

A Risk Profile that explains the upside and downside of every stock pick

Starter Stocks: If you are just starting a portfolio, they will tell you their 10 rock-solid stocks that should be the foundation of your portfolio

Fool Knowledge Base: 24/7 access to their full library of reports and research to help you get their opinion on other stocks that you might own or be considering buying

Market News Updates: They keep you informed of all noteworthy news and trends in the investing world.

How Much Does It Cost?

The normal price is $199 a year. No commitment. Cancel any time. However, they constantly run pricing promotions for new customers like “TRY IT FOR JUST $19” and “50% OFF for New Subscribers.”

CLICK HERE to see their CURRENT promotional offer for NEW customers.

More Motley Fool Details…

If you want more info, please keep reading. And don’t worry, in this review I’ll cover everything–including the good, the bad and the ugly.

I’ll even dive into the details and show you some screenshots of the actual products.

And most importantly, I will show you how their stock picks have performed for me and the differences in results of their two services: Stock Advisor compared to Rule Breakers.

So, keep reading this review of the Motley Fool Review to find out the TRUTH about their stock newsletters and their performances.

You may be surprised with my conclusion.

What is The Motley Fool Stock Advisor and Why Should You Care?

You probably already know a little bit about the Motley Fool and their products.

You may have seen some posts or articles on social media where they provide insights on the stock market.

However, here’s a brief recap of what they do:

The Motley Fool is a stock picking service whose stated goal is to help you learn how to “invest better.”

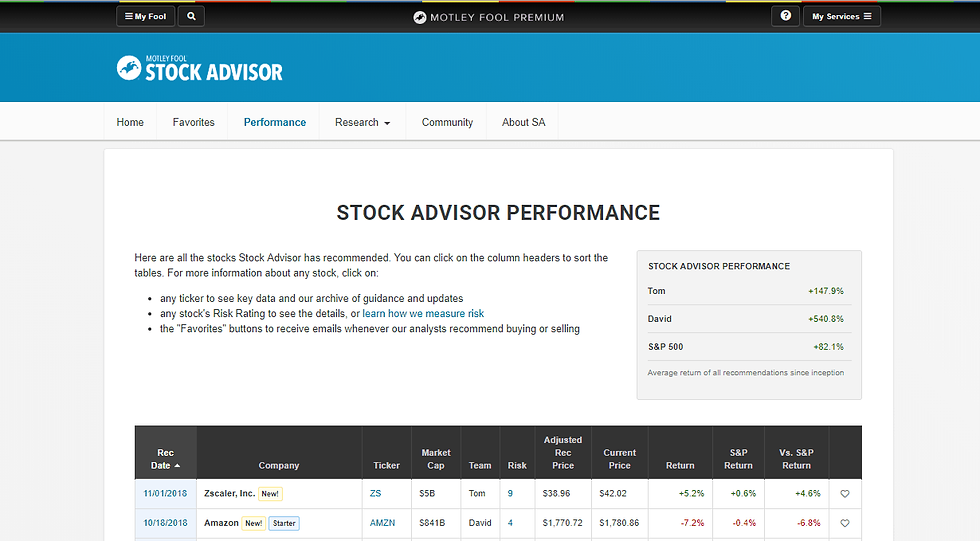

They advertise heavily, often promoting their Stock Advisor’s staggering 356% return since inception compared to the markets 80% return over the same time period.

For that reason, many consider it the best stock newsletter.

Those returns sound great, right?

Take a look at the chart below….it appears too good to be true.

And THAT is exactly why I wrote this Motley Fool Review–to share the results of my experiences with their services.

About the Motley Fool

The Motley Fool was founded by David Gardner and Tom Gardner in 1993. Their most popular stock recommendation service is called “The Stock Advisor” and was launched in 2002.

The Fool’s Stock Advisor service has only one purpose – to help YOU invest, better.

The Stock Advisor (SA) is Motley Fool’s flagship product.

Every month, the Gardner brothers present 12 US stock recommendations that are sent via e-mail and available on their website.

Here’s What You Get…

Every first Thursday of the month, Tom presents one new stock recommendation.

On the second Thursday of the month, David presents one new stock recommendation.

On the third Thursday of the month, Tom presents five of his favorite Best Stocks to Buy Now list.

And on the fourth Thursday of the month, David presents five of his favorite Best Stocks to Buy Now list.

You also get:

A clear explanation of WHY they recommended each stock and the factors considered

A Risk Profile that explains the upside and downside of every stock pick

24/7 Monitoring: They will let you know when they believe it’s time to sell

Starter Stocks: If you are just starting a portfolio, they will tell you their 10 rock-solid stocks that should be the foundation of your portfolio

Fool Knowledge Base: 24/7 access to their full library of reports and research to help you get their opinion on other stocks that you might own or be considering buying

Market News Updates: They keep you informed of all noteworthy news and trends in the investing world.

As you might have noticed, Thursday is their favorite day.

That’s when new stock recommendations come out. On Thursdays you should be expecting to receive your email shortly after noon ET and you need to be ready to invest.

An Example Recommendation

Here is what one of the recent Thursday “Best Stocks to Buy” emails looked like…

Here’s something else you MUST KNOW–Tom and David Gardner are still running the company and providing these stock recommendations! So there has been no changeover in management. If you look at other newsletters, you can’t compare one year to the next because they have so much changeover and you never know whose advice you are following. This is a STRONG POINT for the Motley Fool’s service!

OK, back to the Review of the Motley Fool…

If you like analogies, you can think of the service as a Hollywood movie…

The cop (you) knows a confidential informant (The Motley Fool).

The informant has all the juice (the good stocks to buy) and shares that information with you.

It all happens in the underground world (the stock market).

Since these stocks have already been analyzed and reviewed by a trusted source, all you have to do is log into your brokerage account and invest!

It makes life easy.

If you have doubts about one of their suggestions or would like to know more about a stock recommendation; you can pull up the coverage page which will display the analysis of the stock.

If you don’t have time to read their entire analysis, you can look on the right panel where they give a “1-Minute” presentation.

I love that feature! Here’s how it looks:

Notice the date of this recommendation…April 20, 2018 when the stock was around $42. I purposely picked this one to show you because it was the Fool’s top performing stock pick of 2018.

Also notice the copy above says it was first recommended in January 2018 when it was around $29.18.

As of December 21, 2019 it closed at $116.22 so that stock alone is up 298%! This is just one of their stellar stock recommendations that has tripled in the last year:

In January 2018 they also recommended PAYC that is up 189% and in February 2018 they recommended FICO which is up 124%.

In March 2018 they re-recommended OKTA and it is up 177% since then.

Late April 2018 they also recommended SHOP which is up 207%.

Then in May 2018 they re-recommended SHOP and it is up 188% since then.

Early November 2018 they recommended MA which is up 53%

In January 2019 they recommended TWLO that is already up 23%

In February 2019 they recommended APPN which is up 22% and NTDOY which is up 42%

Their April pick of ZNGA and May pick of SNPS are both up 15%

In October 2019 they recommended NBIX which is already up 20%

Their first pick in November of TTD is already up 36% and their second pick in November is up 8%

What you should note in the above examples is that it takes a few months for their stocks to move. Generally, I see that most of their picks are just OK as they tend to move with the market, but they do pick a few stocks each year that double or triple. And it takes a quarter or two of earnings releases to positively surprise the market and then these hot stocks start climbing.

Their November 7 pick is already up 36.60%–Register to get their next stock pick:

Two brand new stock recommendations per month delivered in real-time to your email.

Access to all of the Motley Fool’s stock recommendations they made in 2019, 2018, and 2017.

The Motley Fool’s Top 10 Best Stock to Buy RIGHT Now report that features some of their recent picks that still offer the best potential return.

The Motley Fool’s Top 5 Starter Stocks report that features the ideal stocks that should be the foundation of new investor’s portfolios.

Access to The Motley Fool’s promotional page to get their deep discount pricing. CURRENT offer is their best Ever: Just $19

So, Why Should You Care About the Motley Fool?

You should care for several reasons.

First, it makes investing in the stock so much easier and less stressful. Just read their recommendations every Thursday and buy what they recommend. I just buy the 2 NEW picks each month as the “5 Stocks to Buy Now” are usually re-recommendations of previously selected stocks. Any of their stock picks that go down 8% I just sell off to cut my losses. This helps to keep some cash in the account.

Second, as you can see, they really do pick a few stocks each year that double or triple each year. The gain on those stocks more than makes up for a few of their picks that go down a little each year.

Third, if you are just getting started, its a great place to start and learn about the stock market. Financial advisers agree on very few things, but the one thing they ALL AGREE ON is the sooner you start investing in the stock market they better off you will be in a few years.

I’m on a quest to become financially independent sooner than later. So, I’m going to take all the help I can get to get there faster.

Here’s another IMPORTANT RESULT: Subscribing to the Fool helps you save more of your money because you WANT to have cash in your brokerage account ready to buy their next stock pick. It really forces you to save because you don’t want to miss out!

None of us have the time nor the skills to analyze thousands of stocks and then decide which ones are the best ones.

The Stock Advisor (SA) subscription is tailored to the Individual Investor to do exactly that.

I will explain why later on in this Motley Fool Review.

What Do You Get?

As a Stock Advisor (SA) member, you’ll have unlimited access to all of their current and historical stock recommendations. The suggested stocks also come with related articles if you wish to read more on the suggestions.

You’ll also get access to their “Favorites” page, which allows you to customize a list of stocks that you are interested in following. That page looks like this:

It also includes “Instant alerts“. They will send you an instant alert as soon as one of these events occurs to a stock in your list:

New buy alerts

When it is time to sell (this is huge)

Large price changes

Additionally, you’ll get have access to the Fool’s research page, which presents premium articles and reports that cover most US stocks.

Their reports page is very interesting and presents numerous trending topics in our society such as virtual reality, self-driving cars, lithium batteries, pot stocks, etc.

For example, they just released a list of “The 10 Best Stocks to Own Today” that present the best opportunities in today’s fastest growing industries.

The Stock Advisor (SA) also includes access to the community page, where you can use discussion boards to communicate with other Fools.

Another interesting concept is the “Foolish Companies”, where the boards are company-based.

These boards are available to premium Fool members and can be useful for talking about investing strategies with fellow community members.

Is the Motley Fool a Scam or is it Legit?

I get this question a lot for some reason… I think it’s because people still have a negative view on the financial industry in general. Of course this view point is justified. But it’s still an easy answer: the Motley Fool & their Stock Advisor service is DEFINITELY NOT a scam.

Of course it’s not perfect and won’t be for everyone. But, they definitely are a legit company. I’ll cover more about the pros and cons a little later on.

I also think people may get the wrong impression if they stumble upon tweets like these:

However, you can find those tweets about anything these days!

The fact is, the Motley Fool stock picks have beat the market the last 4 years. My results shown below prove it. That is the most important thing you need to know. Also, they have been in business since 1993 and employ 250+ people. And they currently have 600,000+ subscribers to their Stock Advisor service. 600,000 people can’t be wrong!

Not to mention I’ve been a customer for over 4 years and I am very happy I subscribed because of the performance of my stock portfolio. I just wish I had subscribed earlier.

I know for a fact it is not a scam–my stock portfolio proves it! They deliver exactly what they say they will deliver, and I have even met a lot of their employees at various investor education conferences that I travel to.

Like I said earlier, I subscribed because I saw their advertising about their great returns, and I had to subscribe to test it out myself.

Of course, as an investor, you should feel free to do your own due diligence and investigate the company before taking any investment advice.

Motley Fool FACTS

But, for the benefit of people reading this Motley Fool review, here are the FACTS from my Motley Fool Review:

There’s no question is a legit company that is very well known among investors. They say they have over 600,000 subscribers.

I subscribed in 2016 and my results are listed below in the next section. Here is the summary–every year for the last 3 years they have beat the market by more than 26%:

The average return of their 24 picks for 2018 is 57% which is 37% better than the SP500;

the average return of their 24 picks from 2017 is 65% which is 27% better than the SP500; and

their 2016 picks are up 143% compared to the SP 500’s 63% so those 24 stocks have beat the market by 80%!

3. They even have their own mutual fund, which is the “Motley Fool Global Opportunities Fund Investor Shares (FOOLX)”. I don’t have any comment on that fund as I haven’t reviewed it yet.

4. Also, the Fool Brothers don’t try to hide from their customers. Which is always a good sign. They are very active in the investment community.

For example, they often have interesting ideas on their certified Twitter page.

The Gardner brothers are also active in the traditional media where they appear on news websites such as AOL News.

Here is an interesting piece on their ups and downs with Amazon.com (they first purchased it in September 1997!)

Now, regarding their Stock Advisor (SA) service, you’re not the first one to have asked this question.

I’ve subscribed the Fool’s Stock Advisor (SA) service for more than 4 years now and I can again reassure you that this is not a scam.

Like many other financial and investment research firm, The Motley Fool has a stock advising service that can be canceled at any time.

Here another testimonial from a customer given on Stackexchange, proving even more how it’s not a scam.

“I’ve had a MF Stock Advisor for 7 or 8 years now, and I’ve belong to Supernova for a couple of years. I also have money in one of their mutual funds. “The Fool” has a lot of very good educational information available, especially for people who are new to investing. Read full testimonial“

Now that we’ve beaten that myth to death, let me tell you what you really want to know.

Will it Help you Make More Money?

The short answer is YES.

That’s proven by their past performance. As I mentioned above, each of their last 3 years their stock picks have outperformed the market by over 26%.

I subscribed in 2016 and my results are as follows (updated as of December 21, 2019):

Of their 24 stock recommendations from 2016, 19 are up, and the average of all 24 picks is +143%.

For 2017, 20 of their 24 picks are up with an average of +65%.

Of their 24 picks from 2018, 18 are up with an average of +57%.

YES, that means the last 3 years they have outperformed the market by and unbelievable 80% in 2016, 27% for 2017 and 37% for 2018.

That is why they are consistently rated as the best stock picking newsletters.

Motley Fool Review – Some Additional Insights

1- It is true that there are many free options to explore, but after testing a bunch of them (I paper traded multiple stock advising services), the Motley Fool provided the most optimal returns and the best bang for the buck.

2- The Stock Advisor is usually $199 a year, but if you are a new subscriber visit this new subscriber page to see their latest offers like 50% off or try it for just $19 with a 30-day 100% membership refund period.

3- There is definitely a “Fool Affect.” With 600,000 subscribers, you must understand that the stocks they recommend do tend to go up about $2 within the first hours of the release of their recommendations. So be ready on Thursday to buy as soon as you get the email.

4- Like with any other investment advisory firm, it’s true that their investment strategies are not 100% guaranteed. From what I have experienced in the last 3 years, they do seem to pick one stock a year that goes down 20-30%. Sometimes they bounce back, and sometimes they don’t. They will, however, let you know when they want you to sell it. My recommendation would be to place a stop loss order based on your risk aversion with trailing percentages and/or fixed prices.

5- After paper trading their stock picks for 6 months, I eventually had the confidence to start buying their picks in my Etrade account. Here are a few screenshots of my account that show the date I bought them and the returns. Notice the TWLO was recommended twice so I bought it twice:

I also feel that their service is very cheap compared to other alternatives that don’t perform as consistently. (Zack’s Investor service is 3x the price)

How Much is a Motley Fool Membership?

The Stock Advisor is now available at its lowest price ever. Last year I paid $199 and if you go to their website you will see the full retail price is $199. BUT–They do run pricing promotions of $19 a month or $99 a year. Either way you can cancel in 30 days and get a full refund. You will also get their “BEST 10 STOCKS TO BUY TODAY” list when you subscribe…

Register Now to get:

Two brand new stock recommendations per month delivered in real-time to your email.

Access to all of the Motley Fool’s stock recommendation in 2019, 2018, and 2017.

The Motley Fool’s Top 10 Best Stock to Buy RIGHT Now report that features some of their recent picks that still offer the best potential return.

The Motley Fool’s Top 5 Starter Stocks report that features the ideal stocks that should be the foundation of new investor’s portfolios.

Access to The Motley Fool’s promotional page to get their deep discount pricing. Try The Motley Fool’s Stock Advisor Service NOW for just $19.

Does the Motley Fool Cover Penny Stocks?

No, the Motley Fool Stock Advisor (SA) focuses on blue chip stocks, which are large & well-established companies in their respective industry. They do NOT review or recommend penny stocks.

Penny stocks are stocks of small publicly traded company that are trading at very low prices per shares (5$ or less in general).

Such stocks are usually highly volatile.

For penny stocks, I would suggest looking into Timothy Sykes, a penny stock trader who made $1.65 million by day trading as a university student.

Tim is now a financial educator and activist, where he donated $1 million to build schools in countries such as Ghana, Indonesia, etc.

He has a couple of teaching segments that you might interest you:

Is the Motley Fool Good for Technical Analysis?

No, definitely not. Technical analysis involves analyzing trade volume and prices and then trying to forecast the direction of stock prices.

The Motley Fool Stock Advisor service is based on the fundamental analysis, which is the study of a company’s financial statements, their competitors, the overall health of the economy, etc.

When investing for the long-term, it is best to analyze a stock’s fundamental, which can define the strengths, weaknesses and overall value of a company.

With the Motley Fool’s stock advisor (SA), the fundamental examination has already been taken care of, where you can read the analysis in their stock reports.

However, if you are an enthusiast of Technical Analysis, you can always perform your due-diligence with the Fool’s recommendations.

Is it Good for Day Traders?

Nope. Day Trading involves buying and selling stocks on the same day. The Motley Fool recommends stocks they want you to hold stocks for years, not minutes.

I personally believe it is hard to be successful as a day trader.

Think about it- You would have to put a heavy amount of cash on one single position and make round trip transactions on one day to be profitable.

As an individual investor, I wouldn’t be comfortable having a large position on one stock. The Motley Fool’s Stock Advisor (SA) is a service that is not suited for day trading.

It is more focused on buy & hold portfolios that is seeking capital growth. This involves a lot less stress and growth for the long-term.

Will it Make Me Rich?

It depends – How much do you invest? How will the Fool perform this year? What will the market overall do?

Rich is relative.

So, will the Motley Fool Stock Advisor (SA) make you rich?

My answer to this question is that over the next few years it should make you “richer” than if you didn’t subscribe!

Then What is it Good For?

I believe this is the easiest way to enter the world of investments and trading.

Being exposed to the Motley Fool’s stock recommendations and what the Gardner brothers have discovered will help you pinpoint what is essential in building a profitable portfolio.

Whether it’s for general knowledge of the market or for using for investment purposes, I believe the Stock Advisor is a tool that you should have in your trading bookmarks.

You don’t need a fancy degree or a job at Goldman Sachs to make money in the stock market.

The Motley Fool has made it easy and affordable for the regular Joe/Jane to start investing and to start making real returns.

Motley Fool Review Conclusion…

So… is the Motley Fool Stock Advisor worth it?

The short answer is YES.

If you skipped my entire review and came right down to the conclusion, (Good for you; I would probably do the same…) then here is my summary…

Of all the stock subscriptions I have tried over the years, the Motley Fool Stock Advisor gives you the greatest bang for your buck and is most definitely worth the cost.

I’ve been a paying customer for over since 2016. I buy $1,000 worth of each of their 2 specific stock picks every month. Here is a summary of the performance of the Motley Fool’s stock picks since January 2016.

Since I started subscribing in January of 2016, here are their top stock picks:

SHOP is up 1,092%

MTCH is up 685%

OKTA is up 33%

TTD is up 285%

APPN is up 185%

PAYC is up 260%

And their WORST stock picks is STMP which is down 53.70%

Over the last 3 years, 84% of the stock picks have been profitable. So they are not perfect. BUT, they do have a nice history of picking a few stocks each year that double or triple and THAT is what makes their picks so good. Take a look at the BEST STOCK column above and you will see. Also note that the BEST STOCK more than makes up for the WORST STOCK each year.

New subscriber offer

Two brand new stock recommendations per month delivered in real-time to your email.

Access to all of the Motley Fool’s stock picks since inception.

The Top 10 Best Stock to Buy Now.

The Top 5 Starter Stocks that should the foundation of new investor’s portfolios.

Access to The Motley Fool’s promotional page to get their deep discount pricing. Try The Motley Fool’s Stock Advisor Service NOW for just $19.

As I stated at the beginning of this Motley Fool Review, since I started, my portfolio has outperformed the SP500 by at least 27% each of the last 3 years so I can definitely say it’s been worth it.

The biggest negative I experience is:

With over 600,000 subscribers, there is definitely a Fool Effect on the stock prices. Within the first few hours of getting a recommendation, the price of the stock typically shoots up $2 or $3 so I have learned to get my order in quickly.

P.S. If you use this link, you will get a 50% discount. (I don’t know how long it will last…) Click Here

If you did read my entire Motley Fool Review and want more details as to why I’m recommending it, let’s get started.

So How Does the Motley Fool Stock Advisor Service Compare to Their Rule Breakers Service?

The Rule Breaker service works in much the same way as Stock Advisor. The differences are:

Rule Breaker’s picks are coming from just David Gardner and his team

You still get usually 2 new stock picks per month

But these picks focus on high-growth stocks that they feel are poised to be market leaders

The results of Rule Breakers stock picks are MUCH MORE VOLATILE than the Stock Advisor’s picks

Over the last 4 years, the Rule Breakers picks have outperformed the Stock Advisor’s picks

The biggest winning stock each year has a much bigger gain than Stock Advisor’s biggest winning stock each year

But their biggest LOSING stock has a much bigger loss than Stock Advisor’s biggest loosing stock each year

Their profitable pick percentage is lower too, so fewer of their stock picks actually go up compared to Stock Advisors

BUT, because of the great success of a few of the Rule Breakers picks each year, if you bought all 24 of their picks each year your portfolio would be about 8% higher with Rule Breakers than with Stock Advisor’s.

Conclusion: Rule Breakers picks have higher returns, but more variance as well. So if you missed out on just one Rule Breaker pick each year, your results could be significantly worse.

For more information on Rule Breakers, see our Motley Fool Rule Breakers Review article.

The Math Doesn’t Lie

The reason I think the Motley Fool services are worth the money is because it pays for ITSELF! That means it’s basically free. The math is very simple…

If you take advantage of this offer now, then the service will only cost $99/year or $19/month.

That means that in order for it to pay for itself, it only has to produce 1 trade that makes at least $20.00.

Here’s an example: If I invest $1,000 in each of their 24 recommended stocks each year and the average stock increases by only 1.0% (that’s peanuts…), then I would make $240 a year. If you invest only $500 in each pick then you would still make $120 a year.

The reality is their picks have been up at least 30% each of the last 3 years so if you had invested $1,000 in each of the 24 picks per year you would make $7,200 a the first year, $14,400 the second year and roughly $21,600 the third year. And if you had invested just $500 in each of their picks you would have been up 1/2 that.

The math doesn’t lie.

It’s a no-brainer when you take a closer look into the Math.

The reality is that because of the Fool’s service, i was able to invest in Amazon 3 years ago!

Back then, Amazon was trading at about $330.

Now, Amazon is trading at roughly $1900!

That’s a 475% gain in only 3 years!

Again, the Math doesn’t lie…

So, that’s why i felt i had to write this review.

Many people have when people asked me if I am pleased with the Motley Fool’s service. My answer is always ABSOLUTELY.

That is, until the day that the math doesn’t work out…

I don’t have any emotional connection to the Fool’s Stock Advisor product. So, as long as I am making more money than it’s costing me, i will recommend it.

As soon as it’s stop working for me, I’ll be the first to tell you.

Let me know what you think in the comments.

If i missed anything or if you have any questions about my Motley Fool Review.

Have you had success with the Fool’s Stock Advisor service?

If so, i want to hear about it, drop me a comment below.

P.P.S. Don’t forget, the Motley Fool service is on sale right now. Here is the link.

Motley Fool – Stock Advisor

$19/month

Quality of Analysis

9.8/10

Pros

Best in Class Performance

Thorough Research Reports

Top Stock Picks

Strong Community

24/7 Monitoring & Alerts

Cons

No Penny Stocks

No Technical Analysis

Important Reminder!

The Motley Fool Stock Advisor ranks as our #1 Best Investment Newsletter for the third year in a row.

Their stock recommendations continue to beat all of the other newsletters and they maintain a very high accuracy of their picks. Their 24 stock picks from 2018 have outperformed the market by an average of 44% as of July 7, 2019. Read that again. I didn’t say their stock picks are up an average of 44%, I said they have BEAT THE MARKET by 44%.

No other newsletter comes close to that. You may have seen the Motley Fool’ advertisements that their picks are up 367% compared to the market’s 80%. Is The Motley Fool’s Stock Advisor really as good as they claim?

Our results, at least since January 2016, suggest YES. You can now get their latest stock picks for ONLY $19/month or $99/year. But this is a special limited time offer. It expires tonight at midnight.

Get the Motley Fool’s Latest picks

P.s. this offer is still backed by their 30-day guarantee

Comments